Sarah Has a 2000 Bond With a 7 Coupon

Thanks 7 The correct answer was given. What are Kristens total earnings for this bond when it reaches its date of maturity.

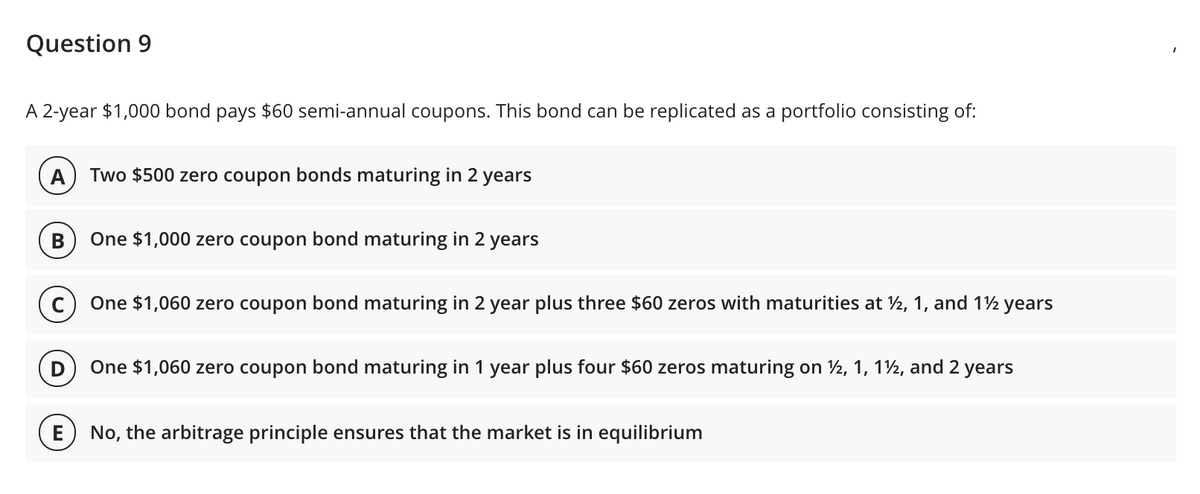

Answered A 2 Year 1 000 Bond Pays 60 Bartleby

It will be 140 per year.

. Advertisement Survey Did this page answer your question. How much interest will Ryan revive for this bond every 6months. Coupon A coupon or coupon payment is the annual interest rate paid on a bond expressed as a.

A company has a bond loan of 2000 bonds with a face value of Rp10000000 each and pays a coupon of 9 per year payable semi-annually. The bond has a yield to maturity of 55 percent. 228 Nouchi has two investment options.

Kristen bought a 2000 bond with a 49 coupon that matures in 10 years. Solution for A 5500 bond had a coupon rate of 475 with interest paid semi-annually. Not at all Slightly Kinda.

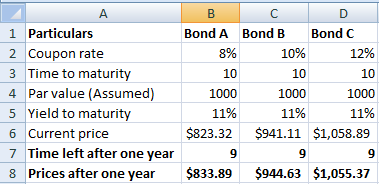

Ctrl- Display Settings Focus. FV 100000 Coupon Payment PMT 1000 x 10 100 Period 10 PV 90000 YTM Rate 10100-900900 1175 2The interest on corporate. Jan 28 2021 0335 AM.

So answer is B. Thus the answer is 840. The Corner Grocer has a 7-year 6 percent annual coupon bond outstanding with a 1000 par value.

How much interest does Sarah earn in 4 years. Given a 7 coupon on a 2000 bond that means Sarah earns a monthly interest of 0072000 140 In that case if she receives the bond every six months then she is to expect the combined interest for the six months which is 6140 840. Option A offers 9 annual interest with a 500000 principal and contributions of.

Hence interestI earned by her. Joseph has a 2000 bond with an 8 coupon. 1 on a question Sarah has a 2000 bond with a 5 coupon.

Sarah has a 2000 bond with a 5 coupon. The Pyramid Chris in Egypt is a. How much interest will sarah receive for this bond every 6 months.

Sarah purchased this bond when there were 8 years left to maturity and. Get 1-on-1 help from an expert tutor now. Ryan has a 3000 bond with 6 coupon.

Which one of the following statements is correct if the market yield suddenly mathematics Sarah holds a bond for 5 years that has a 57 percent coupon rate and a 1000 par value. If the first coupon is 400 and subsequent annual coupons are worth 75 of the previous years coupon find the purchase price of the bond that would yield an interest rate of 10 compounded annually. Bonds and Treasuries.

Correct answer to the question Sarah has a 2000 bond with a 7 coupon how much interest will sarah receive for this bond every 6 monthsa. Answered Sarah has a 2000 bond with a 7 coupon. Then per 6 months it will be 70.

Bond Value 2000 Coupon Rate 8 Annual Coupon Payment Coupon RateBond Value 20008 160 Semi-annual Coupon. View the full answer Previous question Next question. A 2000 bond with annual coupons is redeemable at par in five years.

35 Ratings 20 Votes Solution. The interest earned by her is 50. The yield to maturity is.

The answer is a hope i. Answer Solved Subscribe To Get Solution. Apr 18 2021 View more View Less.

Sarah has a 2000 bond with a 7 coupon. How big is the interest tax shield per year if the company pays 24 income tax. Abhishek G answered on January 30 2021.

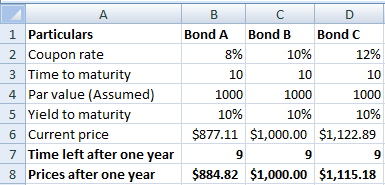

Want this question answered. Now we are asked to find the interest that she will receive after 6 months. Expert Answer 100 7 ratings 1A 1000 par value 10-year bond with a 10 percent coupon rate recently sold for 900.

She will receive in a year 5 of 2000 5100 2000 005 2000 100 In 6 months she will receive 100 2 50 Sarah receive 50 for this bond every 6 months. Sarah holds a bond for 5 years that has a 57 percent coupon rate and a 1000 par value. How much interest will sarah receive for this bond every 6 months.

Sarah has a 2000 bond with a 5 coupon. Sarah has a 2000 bond with a 5 coupon. How much interest will Sarah receive for this bond every 6 months.

How much interest will Sarah receive for this bond every 6 months. The correct answer was given. How much interest will Joseph receive for this bond every 6 months.

14000 Advertisement Answer 48 5 60 Brainly User per year 7 for 2000 bond.

The Valuation Of Bonds Ppt Bec Doms Finance

The Valuation Of Bonds Ppt Bec Doms Finance

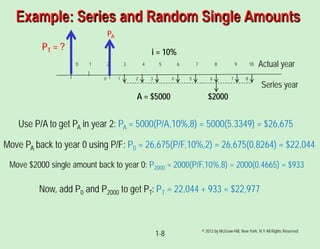

Buku Enginering Economi Edisi Ke 7 Leland Blank

Answered Bond A Has An 8 Annual Coupon Bond B Bartleby

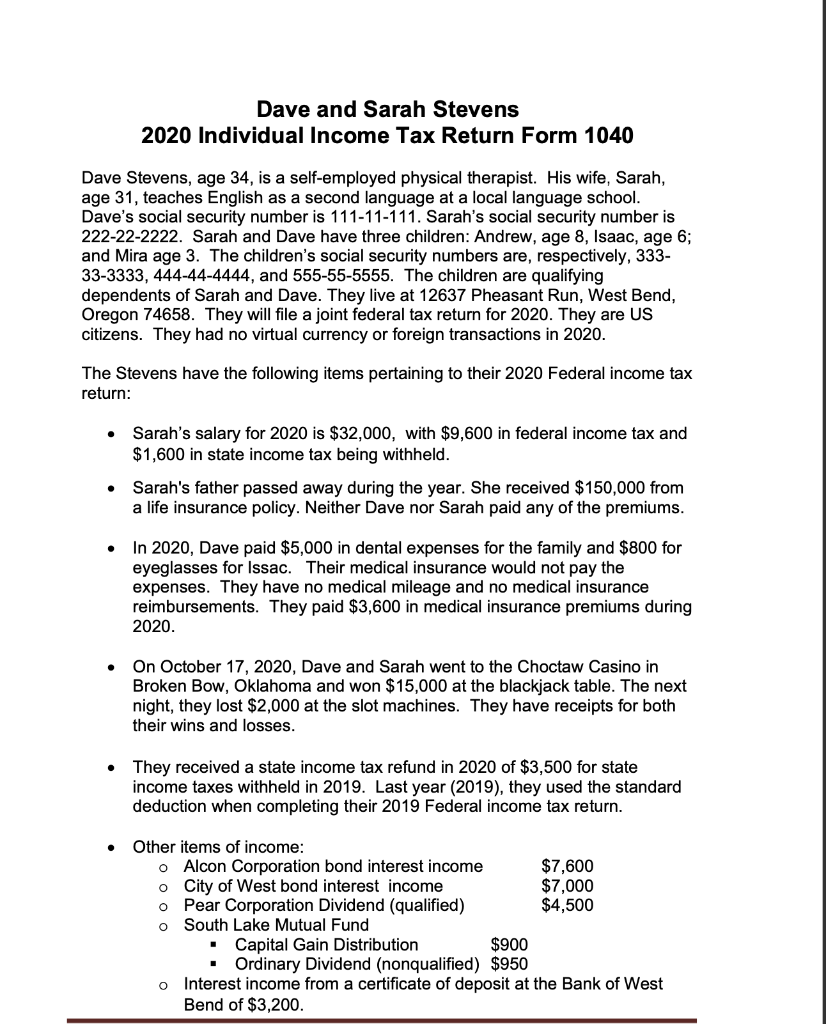

Solved Dave And Sarah Stevens 2020 Individual Income Tax Chegg Com

Materi Pengantar Akuntansi Bonds Payable And Investments In Bonds Pdf Present Value Discounting

Sarah Has A 2000 Bond With A 5 Coupon How Much Interest Will Sarah Recieve For This Bond Every 6 Brainly Com

Chapter2 Exercises Docx 1 Questions And Exercises Chapter 2 Capital Structure Basic 1 Corporate Voting The Shareholders Of The Stackhouse Company Course Hero

Answered Bond A Has An 8 Annual Coupon Bond B Bartleby

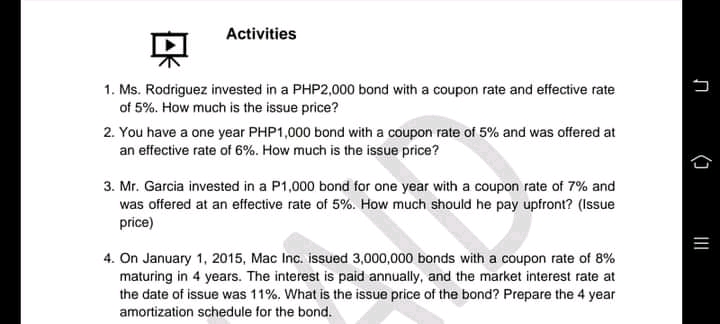

Answered Activities 只 1 Ms Rodriguez Invested Bartleby

Pdf Novel Catalytic Ceramic Conversion Treatment Of Ti6al4v For Improved Tribological And Antibacterial Properties For Biomedical Applications

Instructor S Manual Ateneonline

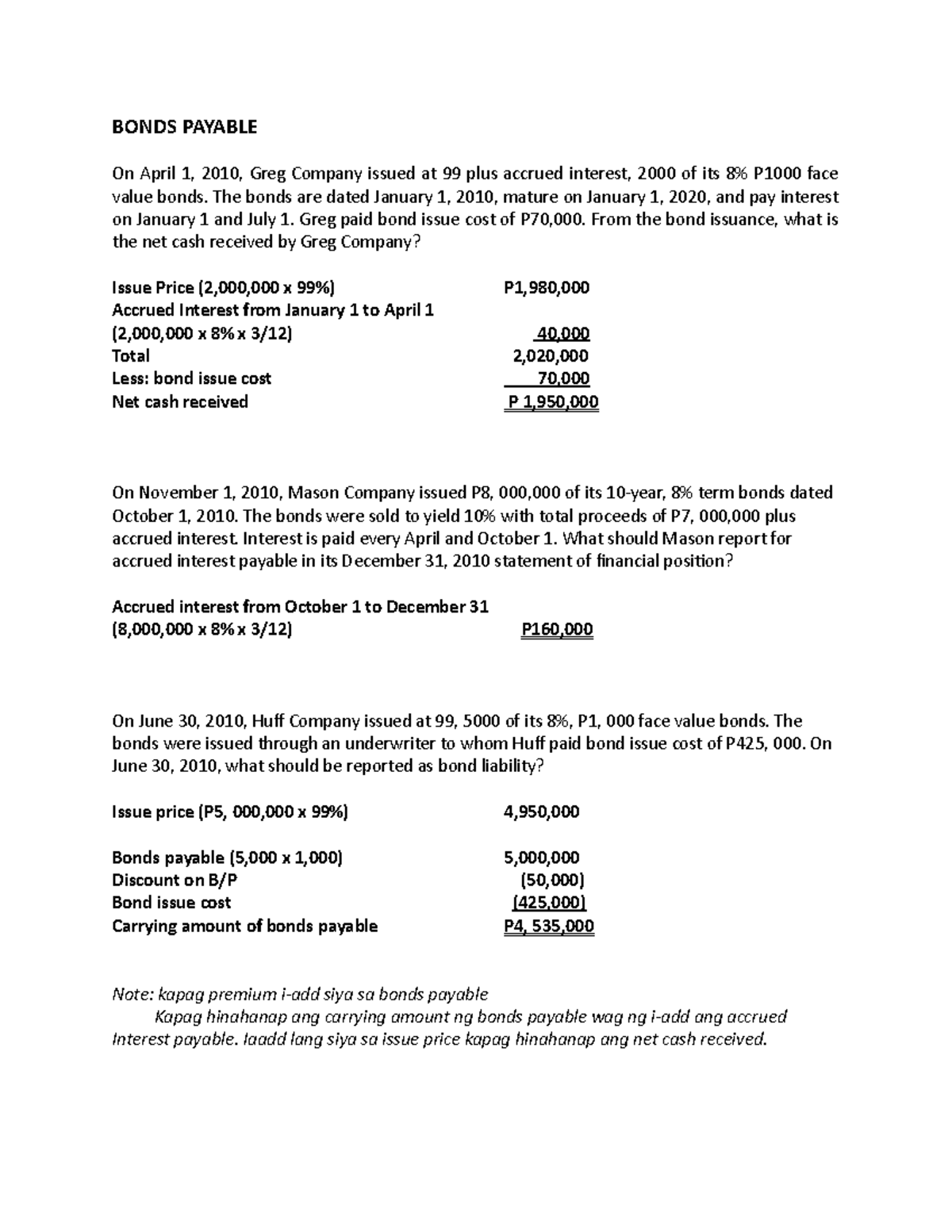

82503837 Reviewer In Prac 2 Prefi Bonds Payable On April 1 2010 Greg Company Issued At 99 Plus Studocu

Comments

Post a Comment